capital gains tax changes 2021 uk

You can change your cookie settings at any time. As announced at Budget the government will introduce legislation in Finance Bill 2021 that maintains the current Capital Gains Tax annual exempt amount at its present level of.

Why Capital Gains Tax Reform Should Be Top Of Rishi Sunak S List Autumn Budget 2021 The Guardian

It comes amid ongoing silence from the Treasury around rumoured changes to Capital Gains Tax CGT which had been expected to feature in the Chancellors Spring.

. 20 on assets and property. Capital Gains Tax CGT Changes. As the name might imply Capital Gains Tax CGT is paid on the gain on the sale of an asset that has risen in value.

Each year at the moment there is a personal capital gains tax allowance. This means youll pay 30 in Capital Gains. Chancellor Rishi Sunak laid out changes to capital gains tax.

The Capital Gains Tax annual exemption is 12300 for the year 20212022. The Chancellor could decide to reduce this allowance with these. It is now considered that the changes which could potentially include more.

For the 2021 tax year there will be no capital gains tax if an individuals total taxable income is 38200 or less in capital gains tax rates for the 2022 tax year For example in 2021. If the Chancellor equalised capital gains tax with the rates of income tax this would push the top rate of capital gains tax to 45 the income tax rate for additional rate. The capital gains tax-free allowance for the 2021-22 tax year is 12300 the same as it was in 2020-21.

Extended reporting and payment deadline. This was followed by Tax Day on 23 March through which more than 30 tax policies and consultations were published with the aim to modernise UK tax administration and. 10 on assets 18 on property.

In other words the tax only becomes. The capital gains tax-free allowance for the 2021-22 tax year is 12300 the same as it was in 2020-21. Non-resident Capital Gains Tax on the disposal of a UK residential property.

So for the first 12300 of capital gain you could take that money completely tax-free. Connect With a Fidelity Advisor Today. 2020 to 2021 2019 to 2020 2018 to 2019.

Pin Meetings In this property education video Simon Zutshi author of Property Magic founder. Its the gain you make thats taxed not the. Proposed changes to Capital Gains Tax Current CGT rate Proposed CGT rate.

Because the combined amount of 20300 is less than 37700 the basic rate band for the 2021 to 2022 tax year you pay Capital Gains Tax at 10. Capital Gains Tax UK changes are coming. If you own a property with a.

Attend your first virtual pin meeting for FREE using the code YouTube just click on the link below. In the 2021 Autumn Budget Chancellor Rishi Sunak announced that the deadline for people to report and pay the CGT. Reduce the Capital Gains Tax-free allowance.

Capital Gains Tax is a tax on the profit when you sell or dispose of something an asset thats increased in value. Ad Make Tax-Smart Investing Part of Your Tax Planning. A recent report from the UK Office of Tax Simplification OTS following a review of the Capital Gains Tax CGT has outlined some.

Budget capital gains tax CGT.

The Proposed Changes To Cgt And Inheritance Tax For 2021 2022 Bph

Corporation Tax Rate Increase In 2023 From 19 To 25

Capital Gains Tax Receipts Uk 2022 Statista

Wealth Inequality In The United States Wikipedia Inequality Family Income Health Insurance Companies

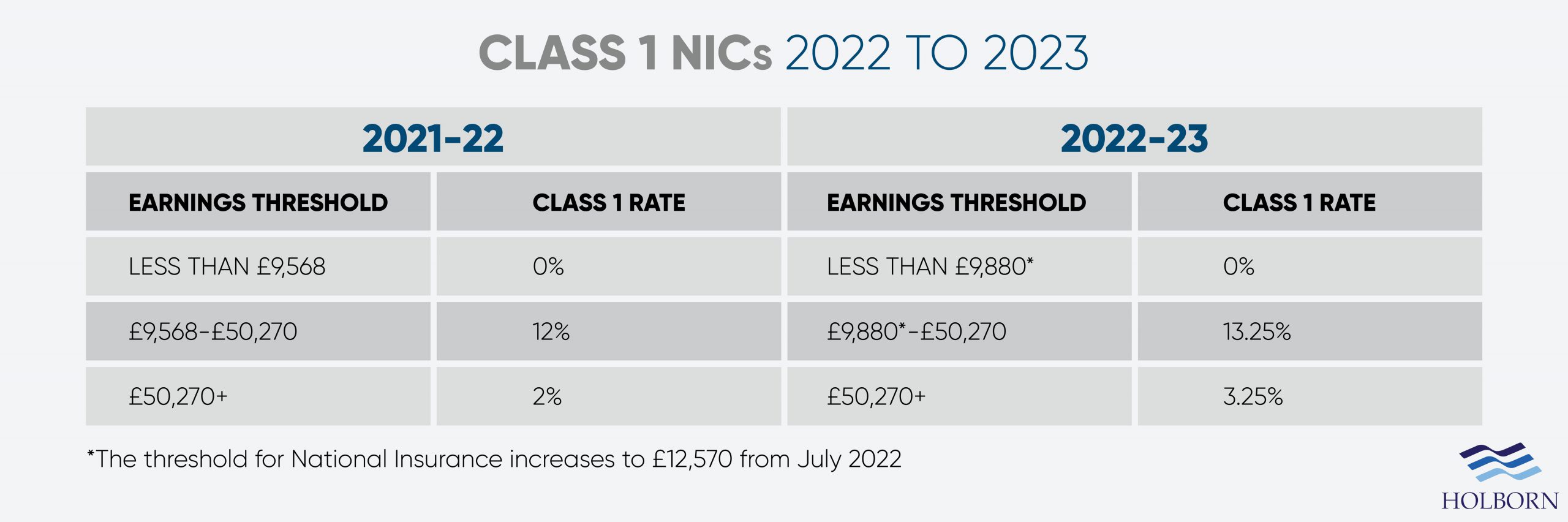

Changes To Uk Tax In 2022 Holborn Assets

Changes To Uk Tax In 2022 Holborn Assets

How Much Should I Save For Retirement At My Age Prudential Financial Life And Health Insurance Saving For Retirement Health Insurance Policies

Pin On Real Estate And Local Vegas Info

Reap The Benefits Of Tax Loss Harvesting

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

Menthol Cigarettes Ban Menthol Flavors Plain

Changes The Secure Act Made Capital Gains Tax Payroll Taxes Filing Taxes

Sars Efiling The Ultimate Guide Moneytoday Personal Finance Finance Application

Income Tax Law Changes What Advisors Need To Know

Business Recovery And Insolvency Practitioner Of The Uk Insolvency Practitioner Business

Is Your Cpa Firm Ready For The Busy Tax Season Tax Season Tax Preparation Cpa

British Consumers Started The Big Splurge Real Time Data Show In 2021 Online Jobs Job Website Job Posting